What Services can a CSP Provider offer to the Rural People?

Kiosk Banking Empowers Rural Entrepreneurs

October 12, 2023

What is the Role of a CSP Provider?

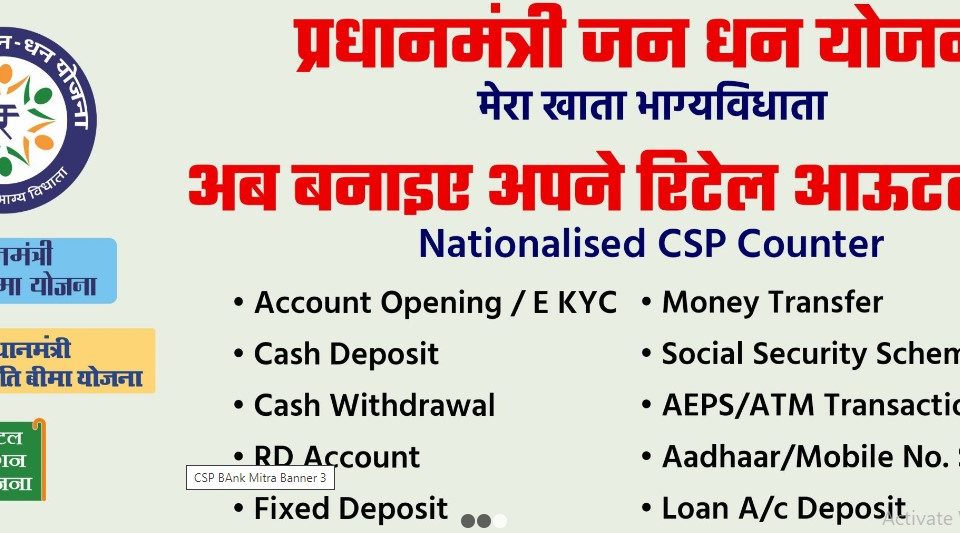

December 18, 2023A CSP provider of a nationalized bank is in charge of a banking outlet or touchpoint, allowing the public in the locality to access basic banking services. These service providers will usually work in areas where there might not be a physical branch of the bank. Customer Service Points of a nationalized bank are typically run by individuals or businesses as banking agents or business correspondents in the best interests of banks. These points are central in extending banking services to rustic and underserved areas of the country, making financial services more accessible to a wider population.

When you refer to CSP Provider, it suggests a person who the individual or business serves as a Customer Service Point for a single bank or multiple banks. These retail outlets of the bank offer a diversity of banking services. This perception involves partnering with one or more banks to deliver services such as:

Opening of bank accounts: Helping customers to open savings accounts or current accounts.

Money Deposits and cash withdrawals: Enabling people to make cash deposits and money withdrawals.

Money Transfers: Facilitating people to transfer cash in and out of the bank.

Balance Inquiry: Providing people with information about their account balance.

Bill Payments: Accept payments for loan installments, utility bills, and more.

AePS or Aadhar-Enabled Payment System: Providing people with banking transactions based on their Aadhar information.

Providing Loan Services: A CSP outlet may also function as a Kiosk Banking outlet to provide a range of other services, including, assisting people with credit applications and payments.

Delivering Insurance Services: Providing the rural public with insurance products in support of the bank.

The specific services offered by the CSP and kiosk outlets can vary between banks. CSPs will usually get a commission or payment for each transaction they enable.

While providing the village citizens with offering services as a CSP for nationalized banks in the country, they will be capable of offering a broader range of banking services. These service providers will also get many lucrative earning opportunities. However, for a CSP, it is essential to carefully succeed and abide by the requirements of each nationalized bank to uphold afficacious and sustainable CSP business.